Columbus’ Resident E-Bike Subsidy Program Details & Application Preparation

The e-bike application launched on Monday, August 12 and is now closed. To stay informed of any future application openings, fill out the interest survey.

Eligibility Requirements

Must be age 18 and above

Must have a household income of under $150,000 per year

Must be a resident of the City of Columbus.

City of Columbus limits are complex. Enter your address into this map to find out if your address falls within city of Columbus limits. If you are outside of city limits, your address will appear in the gray zone.

Please note: Employees of the City of Columbus are not eligible for the program.

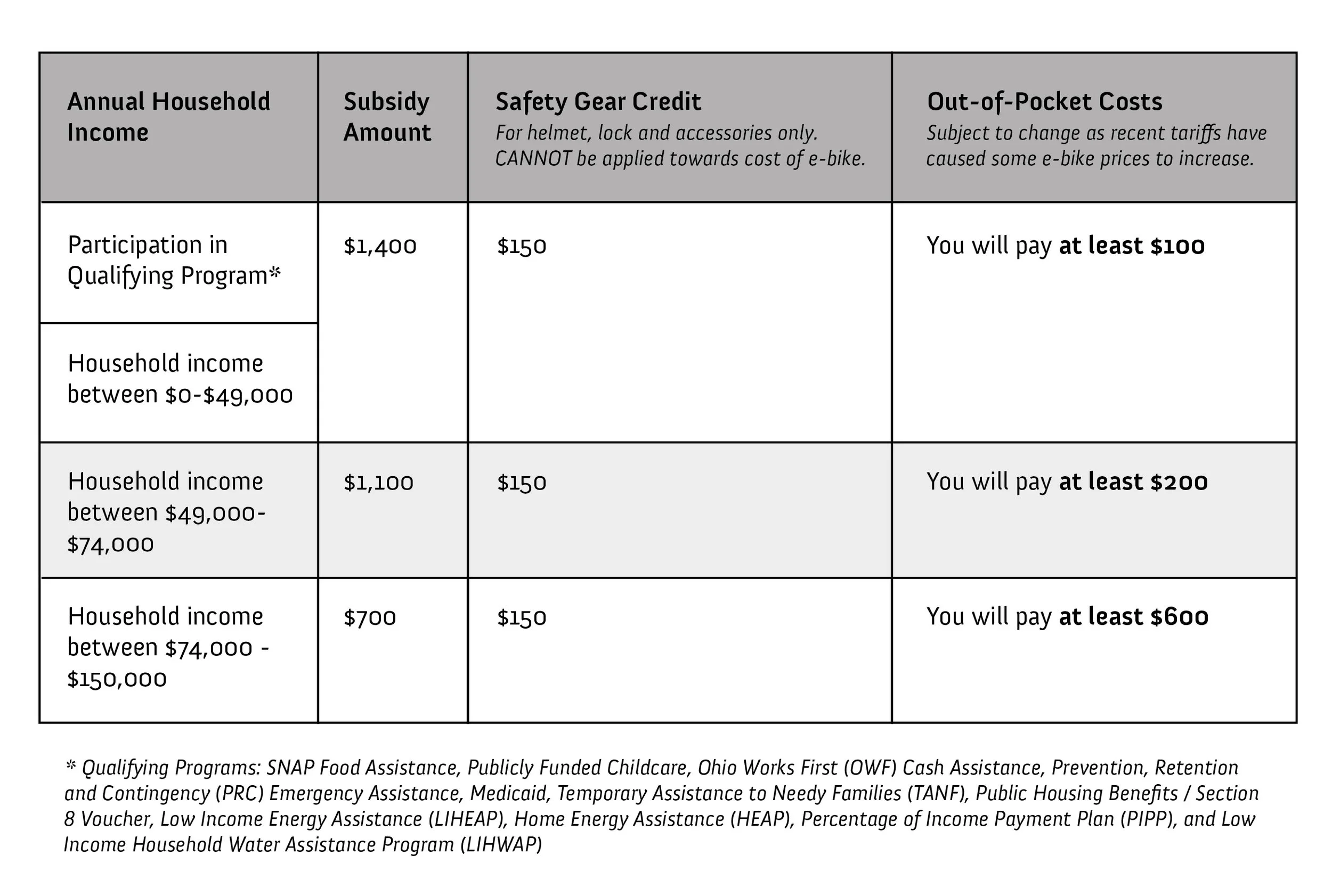

Out-of-Pocket Costs

Subsidy Amounts & Upfront Costs

If you are selected for a subsidy, you will be awarded an amount that is based upon your household income or participation in a Qualifying Program. The subsidy is immediately applied at point of purchase, so you will only pay the remaining amount not covered by the subsidy.

Ongoing Maintenance Costs

On top of the initial out-of-pocket expense, you should plan to spend $300 or more a year on e-bike maintenance.

Why do e-bikes cost more than non-electric bicycles?

E-bikes are incredible machines that provide a new form of transportation that can shorten your commute and in many cases replace a car. The electrical components on an e-bike, such as the motor and battery, are expensive and can make up the majority of the total cost of the bike. Many e-bike parts are also shipped from overseas, which add a significant expense as well.

E-bikes are expensive. Columbus City Council offers this program in order to reduce the cost of e-bike purchases and make them more affordable for Columbus residents.

Choice

Columbus’ Resident E-Bike Subsidy Program is currently prioritizing access to maintenance and the ability to manage quality standards over e-bike selection. This means that if you receive the subsidy, you will have to choose from the offerings of 6 local partnering bike shops.

E-Bike Qualifications & Purchasing Rules

New

Class 1, 2 or 3

Minimum retail cost of $999 (BEFORE discount is applied). E-bikes below this amount are not eligible for this program. This is to manage quality and ensure access to maintenance. There is a significant range in e-bike cost beginning at $999.

The purchased e-bike must be for use by the e-bike subsidy applicant and not for resale. The subsidy cannot be used on a past purchase.

E-bike must be purchased in person through a participating local bike retailer. Subsidies cannot be used online or with non-program participating stores.

E-bike must be purchased at full Minimum Advertised Price (MAP).

All sales are final. You may not return or exchange goods after the incentive code has been processed.

Required Documentation to Apply

Please review the following section carefully. Applicants with incomplete documentation will be considered ineligible.

You must submit TWO documents: (1) proof of residency in the City of Columbus AND (2) Income Verification OR proof of participation in a Qualifying Program.

-

Address on documentation must match address provided in the application.

Provide ONE of the following:

• Ohio Driver's license, Learner's Permit or Identification Card

• Child Support Statement or Account Summary from Ohio Department of Job and Family Services

• Proof of Home Ownership (Property Deed, Property Tax Bill or Auditor Tax Statement)

• Bank Statement

• Federal or Ohio Income Tax Return Filing

• Court Order Of Probation, Parole, Or Mandatory Release

• Renter, Homeowner, Life, Or Automobile Insurance Policy Or Card

• Credit Card Statement

• Mortgage Account Statement

• Social Security Administration Document

• Electric Bill

• Telephone Bill

• Water Bill

• Sewer Bill

• Cable Bill

• Satellite Bill

• Heating Oil Bill

• Propane Provider Bill

• Gas Bill

• Public Assistance Benefits Statement -

Documents must have APPLICANT NAME and be DATED WITHIN ONE YEAR or application will be denied.

Provide ONE of the following:

• 2023 Federal tax form 1040 (First page only)

• W-2 Wage and Tax Statement (If you are in a dual income household, upload W-2 documents for both earners)

• Pay Stub within the past 3 months (If you are in a dual income household, upload pay stubs for both earners)

• Benefit Letter from Social Security

• Pension Award Statement -

Documents must have APPLICANT NAME and be DATED WITHIN ONE YEAR or application will be denied.

Provide proof of participation in ONE of the following programs:

Proof of participation examples include: Verification Letter, Benefits Summary from Ohio Jobs and Family Services, Screenshot of online profile showing that your status with program is active, any other correspondence with program that shows name and date within the past 12 months, etc.

• SNAP Food Assistance

• Publicly Funded Childcare

• Ohio Works First (OWF) Cash Assistance

• Prevention, Retention and Contingency (PRC) Emergency Assistance

• Medicaid

• Temporary Assistance to Needy Families (TANF)

• Public Housing Benefits / Section 8 Voucher

• Low Income Energy Assistance (LIHEAP)

• Home Energy Assistance (HEAP)

• Percentage of Income Payment Plan (PIPP)

• Low Income Household Water Assistance Program (LIHWAP)